If your vehicle suffers a total loss, is damaged or stolen, SecureDrive Vehicle Loss Privilege Program gives you an in-store loyalty credit to help put you into a new vehicle.

Privilege options tailored to you

Vehicle Loss Privilege Program gives you an in-store loyalty credit to help put you into a new vehicle. Choose from three options.

You’ve Got Options

Choose from three different privilege options, depending on your needs. You can select plan options individually, or bundle them together for ultimate protection.

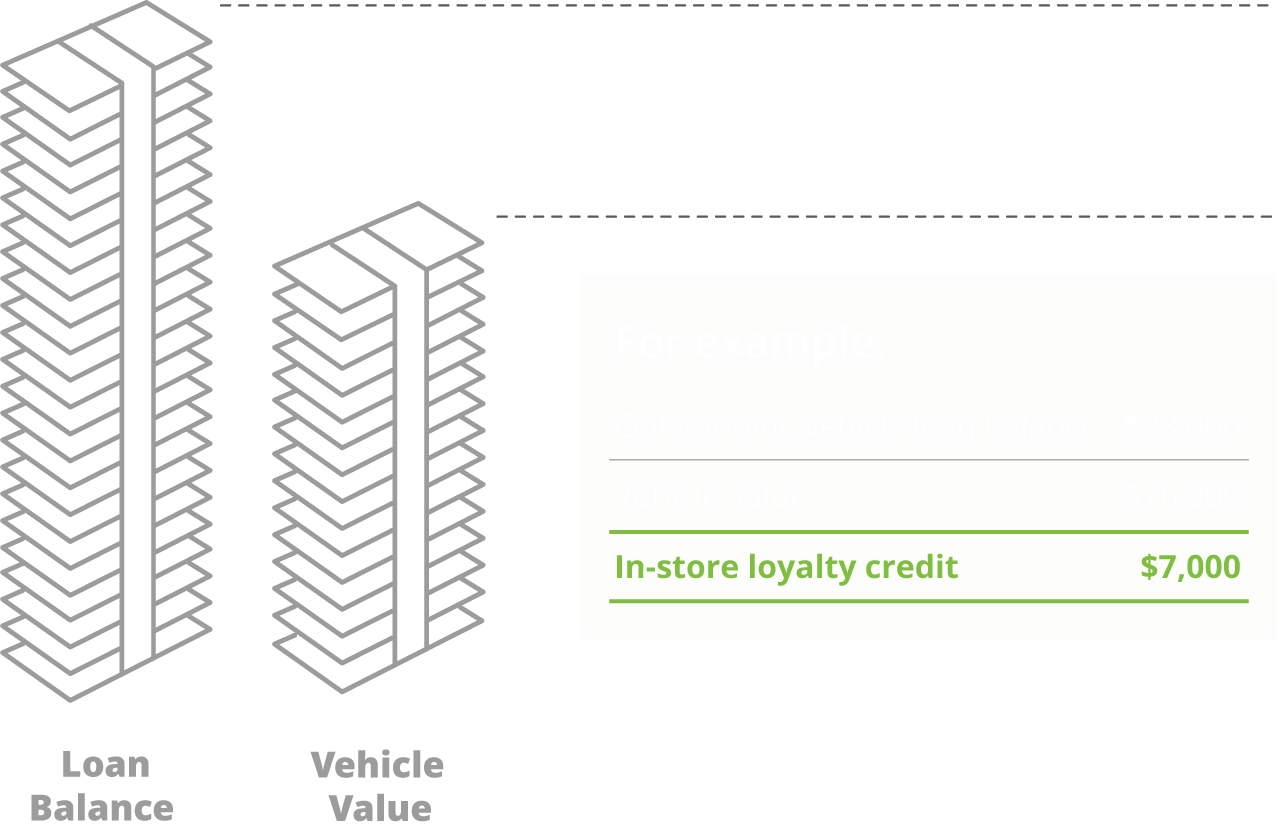

Negative Equity

Imagine your vehicle is declared as a total loss by your insurer (result of collision, fire or theft) and you owe more money on your vehicle loan than what the vehicle is actually worth. Negative Equity gives you an in-store credit that covers the difference between the outstanding balance of your loan and vehicle value.

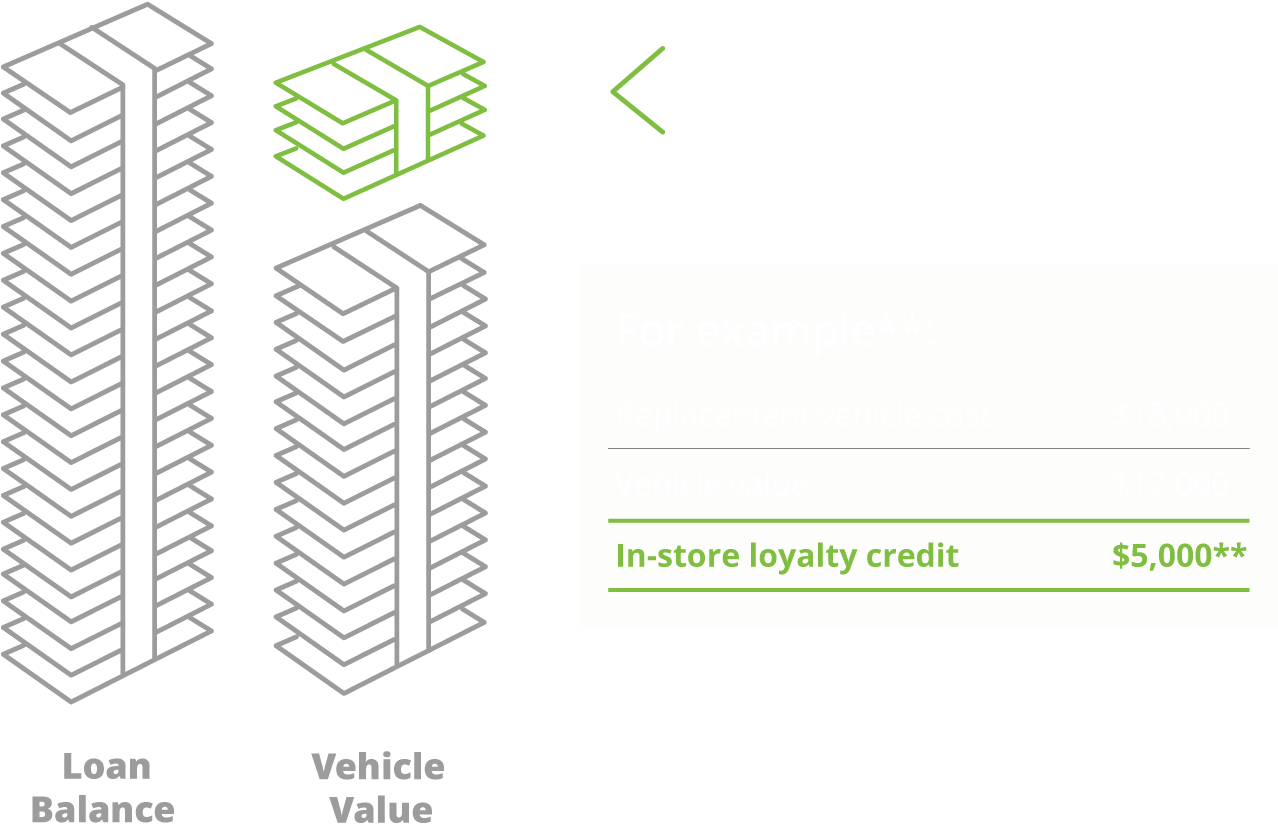

Total Loss Event & Partial Loss Event Privilege

if your vehicle is damaged or faces a total loss, receive a fixed, in-store loyalty credit to put towards a replacement vehicle.

Theft Event Privilege

If your vehicle is stolen and not recovered, receive a fixed, in-store loyalty credit to put towards a replacement vehicle.

In-store Loyalty Credit Options

Different credit options to match your vehicle’s value

| Vehicle Value | In-Store Loyalty Credit Options | |||

|---|---|---|---|---|

| Negative Equity Privilege.* | Loan Value up to $150,000 | Deficit between the insurer payout and the ramaining loan balance up to 150% of the vehicle MRSP | ||

| Total Loss Event Privilege.* | Up to $20,000 | $5,000 | ||

| $20,000 to $40,000 | $5,000 or $7500 | |||

| $40,000+ | $5,000, $7,000 or $10,000 | |||

| Theft Event Privilege.* | Up to $20,000 | $5,000 | ||

| $20,000 to $40,000 | $5,000 or $7500 | |||

| $40,000+ | $5,000, $7,000 or $10,000 | |||

| Partial Loss Event Privilege.* | Up to $20,000 | $5,000 | ||

| $20,000 to $40,000 | $5,000 or $7500 | |||

| $40,000+ | $5,000, $7,000 or $10,000 | |||

Know the facts

*J.D. Power. (2015). July 2015 Automotive Market Metrics. Retrieved from: https://tinyurl.com/y59q8ehq

**Statistics Canada (2017). Police-reported crime for selected offences, Canada. Retrieved from: https://tinyurl.com/y35ftxqr

*** Insurance Bureau of Canada. (2015). Facts 2015. Retrieved from: https://tinyurl.com/y4yvfvcb .

Benefits from day one

Enhance your plan with a benefits bundle that starts the day you purchase your vehicle.

Frequently Asked Questions (FAQs)

Find answers to our most frequently asked questions. If you still have questions, feel free to reach out to a SecureDrive advisor or your local selling Dealership.

When can I purchase Anti-Theft Protection?

At any time! For maximum protection, we recommend getting Anti-Theft Protection is when you first buy or lease your new vehicle.

Where can I buy Anti-Theft Protection?

You can contact your local SecureDrive™ selling dealership to discuss all available SecureDrive™ protection products and purchase from them. To see a full list of SecureDrive™ dealers, click here.