Before you hit the road with your new car, you’re probably looking at your payment options. If cash is a no-go, two payment options are available to you: financing (taking out a loan) or leasing the vehicle. It’s important to know that the option you choose will translate into very different financial obligations.

Payment options

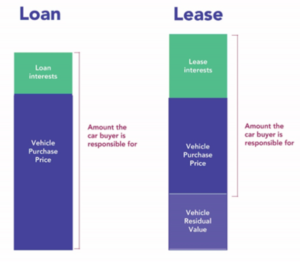

1) Financing: If you opt for securing a loan to purchase your vehicle, you’re deciding to become its proud owner. The amount that you will pay is:

- the total price of the car,

- interest for the loan,

- a few additional taxes.

For example, if the new car’s price tag is $30,000, and your loan has an interest rate of 2%, you will be paying roughly $30,600 total over the loan term.

2) Leasing: If you decide to lease your vehicle, you will not own it, but benefit from using it for a certain period of time before, in most cases, returning it.

Unlike financing, where you are responsible to pay for the full price of the car, this time, you will only be responsible to pay for the depreciation. It is the difference between the value of the car at the beginning of your lease (the purchase price), and its value at the end of the lease (residual value). The residual value will be estimated at the beginning of your lease in order to determine your monthly/weekly payments.

What does that look like? Here’s an example.

- Let’s assume that the vehicle you wish to lease has a price tag of $30,000 and you decide that you want to lease it for 48 months. The residual value at the end of the 48 months, will be set it at $12,000 for the example.

- In this case, you’ll be responsible for paying $30,000-$12,000 = $18,000. On top of that, you’ll also have to pay for some interest and a few additional fees.

Below is a graph summarizing what we just covered.

This means that with a lease, you’ll be responsible for a smaller amount of money than if you were to finance, which can look attractive. However, it’s important to note that leasing comes with additional responsibilities.

Additional responsibilities specific to leasing

- You’ll commit to honor your payments until the very end of your lease term. This means that if you no longer want the vehicle after two years instead of four years (the term of your lease), you can’t simply return it because you are still responsible for the other half of the amount.

- No worries if you really need to get out of your lease though. Some solutions, such as finding someone to take over your lease exists, but charges will apply.

- Your lease agreement will most likely come with some usage conditions: you’ll commit to a maximum amount of kilometres driven every year, and you’ll have to be careful when it comes to wear and tear. Almost every lessor will have guidelines explaining what damages can be accepted and what cannot. You’ll be responsible for paying additional charges for unacceptable damages.

- In such cases, solutions exist to minimize the cost of excessive wear at end of lease. You could for example purchase an Excess Wear and Use Waiver.

- Interest rates tend to be higher for leases than for loans. Even though you’ll be responsible for a smaller portion of the vehicle’s price, the amount you pay for interest could be higher.

We hope that you now have a better understanding of the financial obligations for financing vs leasing. Feel free to share your questions or your experience in the comments!