If your vehicle is stolen or written off, your insurer’s payout may not be enough to fully repay your loan. Guaranteed Asset Protection (GAP) steps in to cover the difference – so you can purchase a replacement vehicle debt and worry-free.

Guaranteed Asset Protection

Protection from debt after vehicle loss.

Eligibility

Vehicle loans of

up to $180,000

New or

pre-owned vehicles

Up to 7 model years

Mind the gap

Bridging the financial gap

Coverage for outstanding debt

We cover up to $50,000 in outstanding debt on initial loan amounts of up to $180,000.

Protection for full loan term

Choose the length of your plan to match your loan, with coverage available up to 96 months.

$1,000 loyalty credit

After a total loss, you’ll also get $1,000 to put towards a new vehicle at your selling dealer.

Insurance deductible covered

If your primary insurer charges a deductible, we’ll cover it up to $1,000.

Down payment coverage (optional)

With this additional benefit, you’ll get back the down payment you made for your vehicle up to $20,000.

How GAP insurance works

Purchase

Finance your vehicle and purchase SecureDrive GAP insurance.

Loss

Your vehicle is declared a total loss (for example, due to theft, fire, flood or accident).

Payment

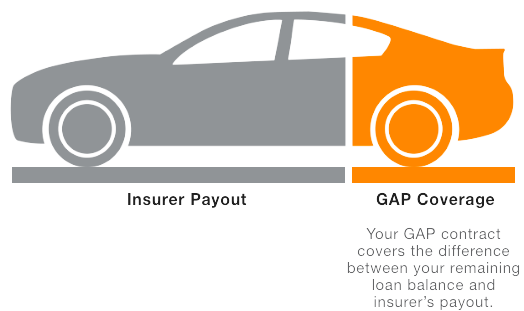

The difference between your insurer’s payout and what you owe on your vehicle loan is covered by your GAP contract.

Frequently asked questions

Am I eligible for SecureDrive GAP?

We cover loans of up to $180,000 where the maximum loan-to-value (LTV) is 170% (LTV means the loan amount compared to value of your vehicle). We cover new or pre-owned vehicles up to 7 model years.

Is SecureDrive GAP available in all provinces?

SecureDrive GAP is available in Alberta and Saskatchewan only.

Can I include SecureDrive GAP in my vehicle financing?

Yes! Your selling dealer will generally allow you to roll everything into your vehicle financing.

Can I use my $1,000 in-store loyalty credit at any dealership?

Your in-store credit will be redeemable at the dealership where you purchased your SecureDrive contract.

Does SecureDrive GAP cover me if I use my vehicle for light commercial purposes?

Yes, you’ll be covered for personal or light commercial use (ridesharing, food delivery, etc.).

How do I make a claim?

Email the insurer at WarrantyClaims@Trisura.com within 30 days of the loss of your vehicle to initiate the claims process.