Introduction

It’s no secret that buying a car can be both exciting and a bit stressful. Whether you’re buying new or used, you have multiple options to consider. Do you need four-wheel drive? How important is fuel efficiency and reliability? Is the trunk space large enough and does the back seat fold down so you can fit your kids’ skis, camping equipment, soccer gear and the dog? On top of all these decisions on car make and model, you’ll also need to consider vehicle protection – the most common one being extended car warranty. Ensuring you make the right choice and make smart decisions along the way is key to a long and happy car ownership experience.

For approximately 60 per cent of car buyers, an extended warranty can offer value and peace of mind through budget management by limiting financial risk with your new car.

We’ve compiled a comprehensive guide to extended car warranties in Canada to help you decide if an extended warranty is the right option for you.

Guide chapters

- What’s an extended warranty?

- What’s included in an extended warranty?

- Why buy an extended warranty?

- How much do extended warranties cost?

- Where to buy an extended warranty?

- When to buy an extended warranty?

What’s an extended warranty?

An extended warranty, also referred to as a service contract, maintenance agreement or mechanical breakdown protection, typically provides protection for certain mechanical and electrical components once your car manufacturer’s warranty has expired.

Difference between a car manufacturer warranty and an extended warranty

A manufacturer warranty, also called a limited, or factory warranty, generally covers:

- major mechanical or electrical failures

- the first three to five years or 36,000 to 60,000 km from the date of your purchase, whichever comes first

An extended warranty generally covers:

- major component and electrical failures

- additional benefits such as 24-hour roadside assistance and rental coverage

- the entire lifetime of your vehicle, up to 120 months and 200,000 km

What’s included in an extended warranty?

Plans and coverage levels differ by car manufacturer, but in general you can divide extended warranty coverage levels into two categories:

-

- Exclusionary plans: Also referred to as Elite, 5 star and Premium Plus plans, they cover the entire vehicle and list what’s not covered. These are the most comprehensive plans designed to offer the highest coverage. Commonly excluded items include: Maintenance, accessories and cosmetic items.

- Named component plans: These cover the Powertrain (car parts that help generate power in the car) and may include certain components within the rest of the vehicle. They’re often limited in coverage.

Why buy an extended warranty?

An extended warranty doesn’t make sense for everyone, but if you answer yes to any of the below statements, you might want to consider getting one.

1. You’re planning on keeping your car beyond the manufacturer’s warranty or your manufacturer’s warranty has already expired.

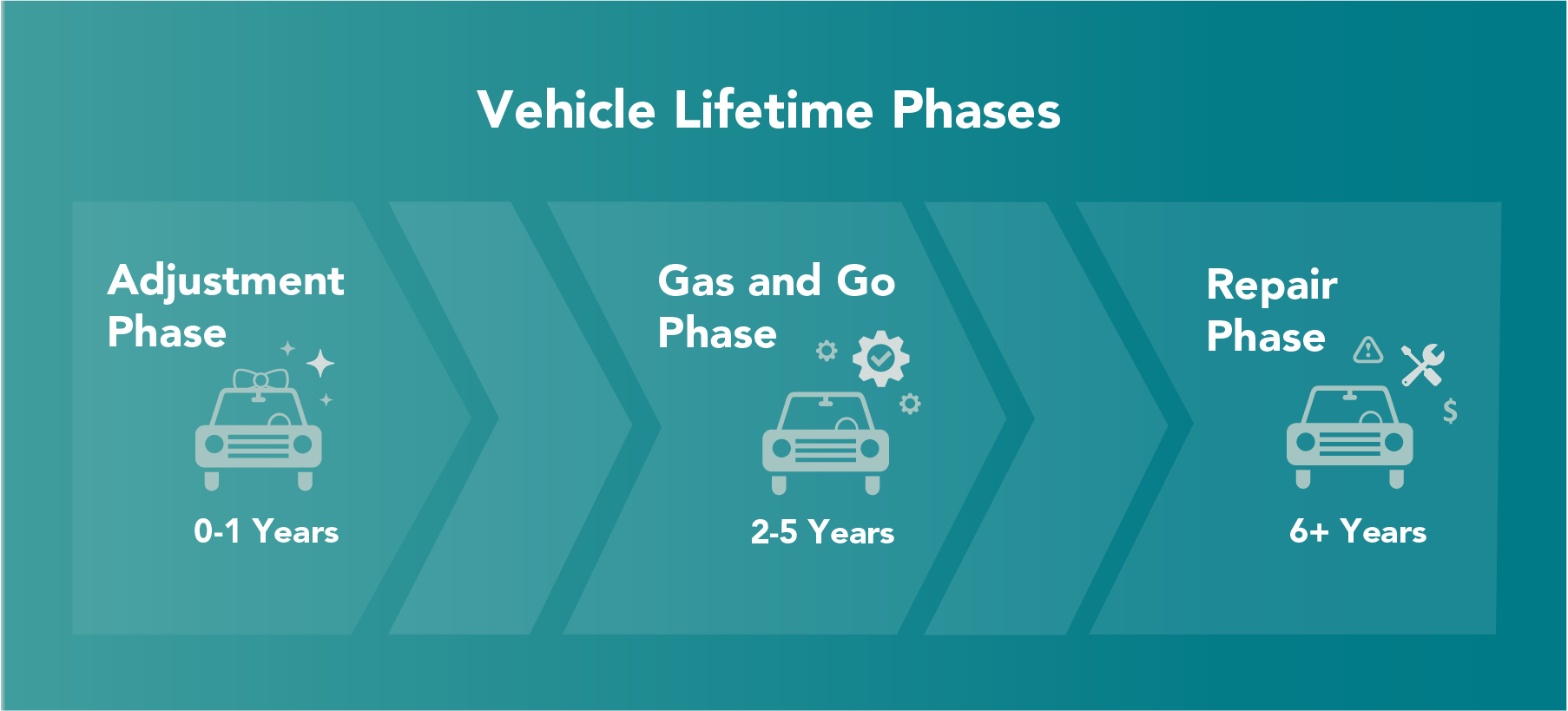

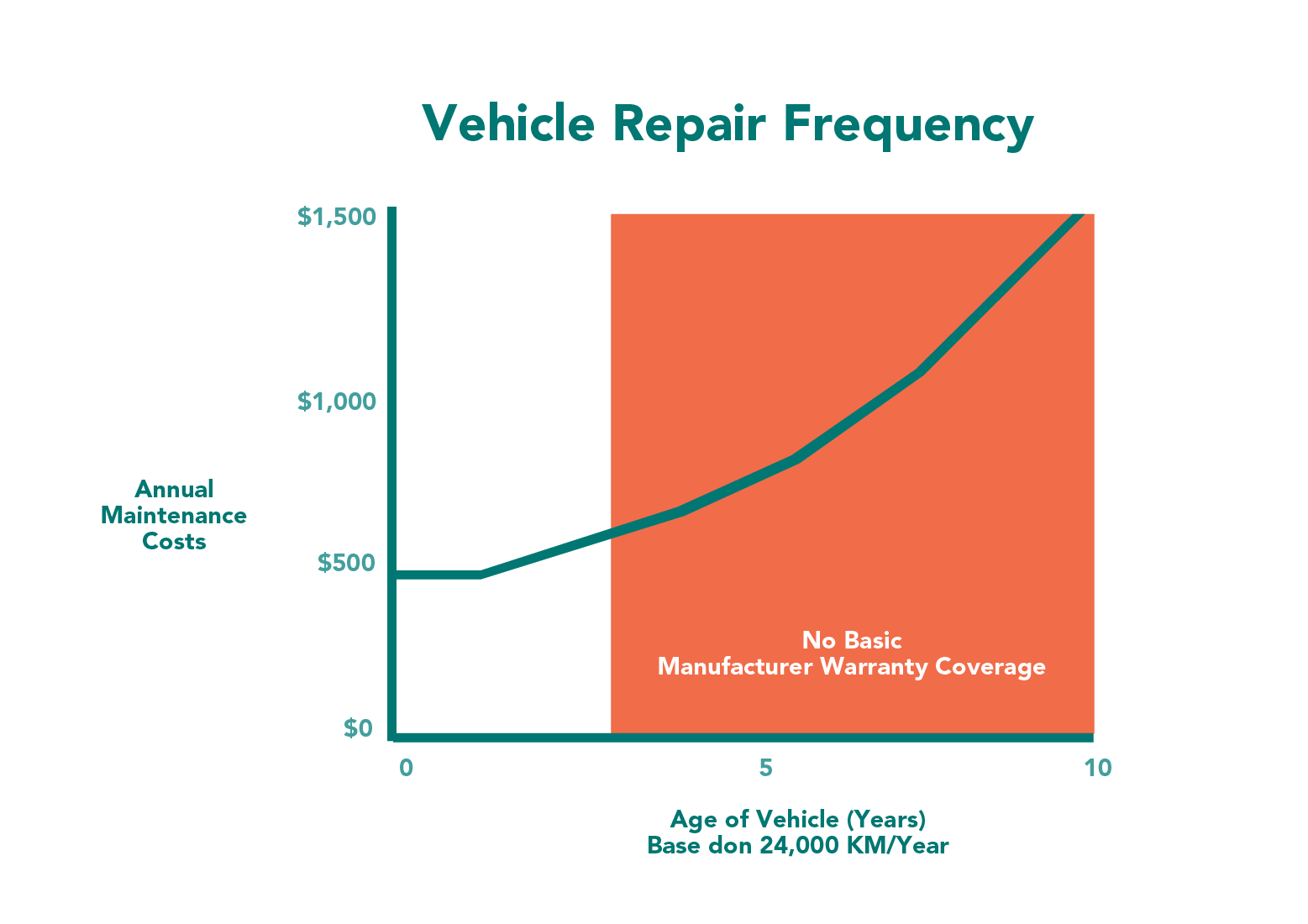

Your car ownership period can be separated into three phases:

- The Adjustment Phase (also known as the break-in period) (0-1 years) Your car just came from the factory and so minor adjustments are made if something doesn’t feel quite right.

- The Gas and Go Phase (2-5 years) The “honeymoon” phase of your ownership, you should be able to essentially “gas and go”. If anything does go wrong, you’re still covered under your manufacturer warranty.

- The Repair Phase. (6+ years) Most cars enter the repair phase after the manufacturer’s warranty ends. During this time, repairs are required more frequently and can often be costly.

If you’re planning on keeping your car past the manufacturer’s warranty coverage and/or your make and model is particularly expensive to repair, you might want to consider purchasing an extended warranty.

2. You drive higher than average kilometers per year.

The average Canadian car owner drives approximately 20,000 km per year. This includes your daily work commute, grocery runs and a road trip every now and then. If you fall outside of the average, then you’ll likely surpass your manufacturer’s typical 3yr/60,000km sooner that you’d like. To ensure coverage for your entire ownership, you might want to consider getting an extended warranty.

3. You want to reduce your financial risk and control your budget

If you don’t like large unexpected costs and are a budgeter. You’ll likely benefit from paying a little a month for peace of mind and to know that an unexpected breakdown down the road won’t blow your budget.

4. You’re buying a used car

Whether it’s two or twelve years old, your teenager’s first car or your second family car, some people feel more confident buying a used car. When buying a used car that can be prone to more repairs and breakdowns, purchasing an extended warranty gives you additional peace of mind.

5. You want to maximize your resale value

Some extended warranties are transferable in a private sale. Whether you sell your car privately or trade it in, having an extended warranty can be a good indicator to the buyer that your car has been kept in good condition.

How much do extended warranties cost?

The cost of an extended warranty can vary greatly by car manufacturer and generally takes into account the car make, model, trim, year, term length, kilometer allowance and deductible chosen. Depending on the level of coverage you’re looking for, extended warranties can run anywhere from $300 for basic 12 months/20,000km coverage to $3000 for comprehensive 120 months/200,000km.

Where to buy an extended warranty?

You’ve decided you’re going to get an extended warranty, now where do you buy it? Depending on how you’re buying your car, one of the below options will make most sense.

From the manufacturer

Your car manufacturer may have an extended warranty program. These are sold through the manufacturer’s dealership network. For example, Kia have Kia Protect Mechanical Breakdown Protection™, sold exclusively through Kia authorized retailers.

From a dealership

Your local dealership will likely offer a variety of extended warranty options designed to meet your needs. You can discuss your options with the Financial Services Manager at the dealership to find a plan that suits your lifestyle and budget.

Online

Some companies offer extended warranties online. These are typically limited to certain provinces as licensing restrictions apply.

When’s the best time to buy an extended warranty?

Buying a new car is an exciting time. Who wants to think about a future mechanical breakdown? Depending on what you’re looking for from an extended warranty, the day you buy your vehicle might be the best time to think about an extended warranty. In most cases you can buy an extended warranty in the below scenarios:

- The day you buy your car

Getting an extended warranty the day you buy your car comes with some benefits.

It allows you to take advantage of additional benefits such as 24-hour roadside assistance right away and you can typically add the warranty cost to your financing or leasing monthly payments.

- When your manufacturer’s warranty is still valid

If you know you’re going to keep your car past the point of manufacturer warranty you might want to consider purchasing an extended warranty early on. Extended warranties are generally more expensive on older vehicles, so opting to buy one before your factory warranty expires can help keep your costs low and more affordable. If you’re a high mileage drivers, keep in mind your manufacturer warranty may expire before your time allowance.

- After your manufacturer’s warranty has expired

Some companies offer extended warranties after your manufacturer’s has expired, either due to time or kilometer allowance. Limits apply and rates can differ the older your car gets. If you’re purchasing a used car from a dealership, you can, in most cases, buy an extended warranty for greater peace of mind. The dealership’s financial services manager will be able to talk you through your options.

Conclusion

An extended warranty isn’t for everyone. Do your research, assess your lifestyle needs, and weigh up the pros and cons for yourself. If you’re someone that’s drives a lot, plan to keep your car for a longer time or you really can’t afford a costly repair, an extended warranty might be for you.

On the other hand, if you’re planning on switching your car out every few years and only drive on the weekend, opting out of extra protection may be worth the risk.